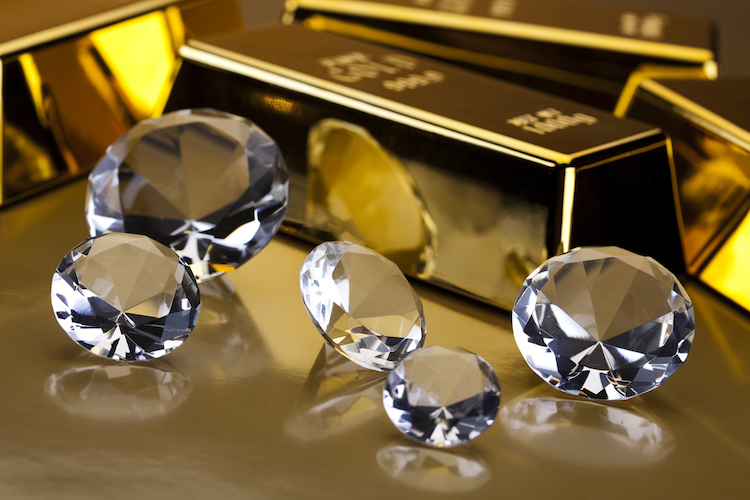

On this planet of investments, few property maintain as a lot attract and mystique as Diamond vs Gold Worth. Each are revered for his or her rarity, magnificence, and enduring worth. However in relation to selecting between them, buyers typically discover themselves at a crossroads, grappling with questions on which holds better intrinsic worth and which affords higher returns in the long term. On this article, we delve into the depths of those two treasured commodities, exploring their histories, traits, and funding potentials.

1. The Origins and Significance of Diamonds and Gold

The Glowing Legacy of Diamonds

Diamonds have captivated human creativeness for hundreds of years, with their brilliance and rarity symbolizing wealth, energy, and everlasting love. Fashioned deep inside the Earth’s mantle over hundreds of thousands of years, diamonds emerge as pure carbon crystals, formed by immense stress and warmth. Traditionally, diamonds have been related to royalty and the Aristocracy, adorning crowns, scepters, and jewellery of the elite.

The Timeless Attract of Gold

Gold, alternatively, has been revered since historic instances for its lustrous magnificence and malleability. Mined from the earth’s crust, gold holds a particular place in human historical past, serving as foreign money, adornment, and retailer of worth throughout civilizations. From the pharaohs of historic Egypt to the kings of medieval Europe, gold has been synonymous with wealth and status.

2. Assessing Worth: Diamonds vs. Gold

Intrinsic Worth

Each diamonds and gold possess intrinsic worth, albeit derived from completely different qualities. Gold’s worth lies in its shortage, sturdiness, and common acceptance. As a tangible asset, gold serves as a hedge towards inflation and financial uncertainty, making it a most popular selection for buyers in search of stability of their portfolios. Diamonds, alternatively, derive their worth from their rarity, readability, reduce, and coloration, collectively referred to as the 4Cs.

Market Dynamics

The market dynamics of Diamond vs Gold Worth differ considerably. Gold, being a globally traded commodity, is topic to fluctuations in demand and provide, geopolitical tensions, and macroeconomic elements. Its worth is set by elements equivalent to rates of interest, foreign money actions, and investor sentiment. Diamonds, nevertheless, function inside a extra managed market Sydney gold patrons, with a handful of firms dominating the availability chain. The diamond market is influenced by elements like shopper demand, mine manufacturing, and trade rules.

3. Funding Concerns: Diamonds and Gold

Portfolio Diversification

Each diamonds and gold supply diversification advantages to buyers. Together with these property in a diversified portfolio may also help mitigate danger and improve long-term returns. Whereas gold serves as a retailer of worth throughout financial downturns and foreign money crises, diamonds present a novel hedge towards inflation and geopolitical uncertainties.

Liquidity and Accessibility

Gold holds an edge over diamonds when it comes to liquidity and accessibility. Being a globally traded commodity, gold might be simply purchased and bought via numerous monetary devices equivalent to ETFs, futures contracts, and bodily bullion. Diamonds, nevertheless, lack a standardized market and are comparatively illiquid property. Promoting diamonds might contain larger transaction prices and longer processing instances in comparison with gold.

4. The Emotional Enchantment: Diamonds Shine Brilliant

Sentimental Worth

One side the place diamonds outshine gold is of their emotional attraction. Diamonds are sometimes related to important life occasions equivalent to engagements, weddings, and anniversaries, imbuing them with sentimental worth past their financial price. The emotional connection individuals have with diamonds makes them cherished possessions, handed down via generations as heirlooms.

Standing Image

Proudly owning a diamond is seen as a standing image, reflecting one’s style, affluence, and social standing. The attract of diamonds lies not simply of their magnificence but additionally within the status they convey. From dazzling engagement rings to beautiful necklaces, diamonds proceed to be prized possessions coveted by the elite.

5. Conclusion: Navigating the Valuable Funding Panorama

Within the everlasting debate of Diamond vs Gold Worth, there’s no clear winner. Each property supply distinctive advantages and attraction to several types of buyers. Gold, with its liquidity and historic monitor document, stays a cornerstone of diversified portfolios, offering stability and wealth preservation. Diamonds, alternatively, supply a mix of intrinsic worth and emotional significance, making them prized possessions past their financial price.

In the long run, the selection between diamonds and gold boils right down to particular person preferences, funding objectives, and danger tolerance. Whether or not you’re drawn to the timeless attract of gold or the glowing brilliance of diamonds, each property have a spot in a well-balanced funding technique. So, whether or not you’re in search of to diversify your portfolio, protect wealth, or just take pleasure in a bit luxurious, do not forget that on this planet of investments, the true worth lies not simply within the property themselves however within the reminiscences and feelings they evoke. Because the saying goes, “Diamonds are endlessly, however gold is timeless.”